NIC Group PLC and Commercial Bank of Africa Limited have announced commencement of discussions regarding a potential merger of the two entities.

In a joint statement to newsrooms, the two financial institutions have said that subject to approvals from shareholders of the two entities and regulatory authorities the two will form one financial institution.

“It is the view of the two Boards that the potential merger would bring together the best in class retail and corporate banks with strong potential for growth in all aspects of banking and wealth management. A combined entity would create a complementary base of over 38 million customers, a strong digital proposition and a robust corporate and asset finance offering,” said the two institutions in the statement.

“It is important to note that an eventual merger remains subject to due diligence processes, shareholder, regulatory and other approvals. During this phase of discussions the two entities will continue to operate independently,” added the statement.

The Boards of Directors of the two bodies have already endorsed the merger plans, and now the ball is on the shareholders and regulator courts.

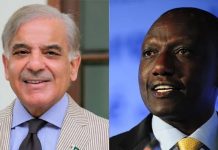

CBA is the largest privately owned Kenyan bank, whose primary focus is Corporate and Institutional banking. It was founded in Tanzania 50 years ago and branches were set up in Kenya and Uganda shortly thereafter.

NIC on the other hand is a full-service bank with 42 branches in Kenya, five branches in Tanzania, three branches in Uganda. It is listed on the Nairobi Securities Exchange with approximately 26,000 shareholders.

NIC has already issued a cautionary statement as required by the regulator in respect to trading of its shares at the NSE.