Kikuyu Member of Parliament Kimani Ichung’wa has indicated that mobile phone loans advanced by banking institutions will have to cap their annual interests rates at 14.5%.

This is after it emerged that mobile phone loans such as Mshwari and Equitel loans have been charging high interests rates ranging between 60 and 100 percent per annum.

The Jubilee MP is also working on a bill that will regulate all other mobile lending platforms including the airtime advance products such as Okoa Jahazi.

If the new proposal is to come to law, a loan of Sh 1,000 paid in 30 days will attract an interest of Sh 12 compared to the Sh 60-100 that is currently charged.

CBA’s product M-Shwari is the dominant mobile lending loan product that currently has 13 million customers and disburses loans for a period of 30 days at an interest rate of 7.5 per cent.

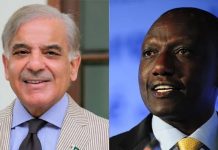

Mr Ichung’wa proposal comes a few days after President Uhuru Kenyatta assented to the 2015 Banking (Amendment) Bill, despite strong opposition from the banking sector.

The Business Daily reported that bank owners lost over Sh5 Billion within a week after the passing of the radical law.

While the newly signed law caps interest loans provided by banks, it is silent on loans provided by other informal lenders.

In the wake of the stringent laws in the bank loans, most banks have turned to the informal lending products to compensate for the lost business.